Calculating interest is a fundamental aspect of financial management, whether you are borrowing or investing. In interest calculation, simple interest has commonly used the method to calculate simple interest. The simple interest loan calculator is a tool that helps users calculate the interest that they will earn or pay using the simple interest formula.

In this article, we know the simple interest formula and how to use the simple interest calcualtor to determine the interest on your loan or investment.

What is Simple Interest and formula?

Simple interest is a type of calculated interest that is calculated on the principal amount of a loan or investment. The calculation of the simple interest formula is:

Simple Interest = (Principal * Interest rate * Time) / 100

Where:

- The principal is the amount of money borrowed or invested.

- Interest rate is the annual interest rate

- Time means the period of year of loan or investment in years, months and days.

For example, if you borrow $10,000 at an annual interest rate of 5% for three years, the simple interest calculation would be:

Simple Interest = $10,000 x 0.05 x 3 = $1,500

This means that you would pay $1,500 in interest over the three-year term of the loan.

How to Use a Simple Interest Loan Calculator?

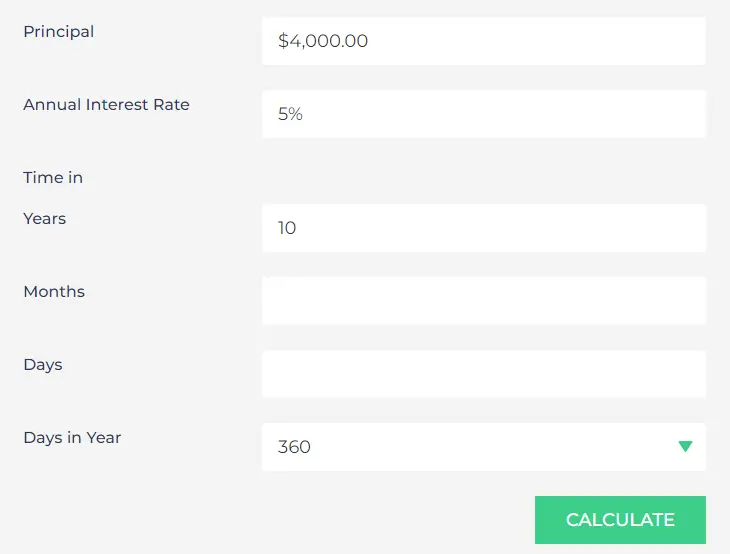

Using a simple interest calculator is a quick and easy way to determine the interest on a loan or investment. To use the calculator, you need to input the principal amount, interest rate, and time period.

Using a simple interest loan calcualtor is a quick and easy way to determine the interest on a loan or investment. To use the calcualtor you need to input the principal amount, interest rate, and time period.

- Input the Principal Amount

- Input the Interest Rate

- Input the Time Period

- Calculate the Simple Interest

- Review the Results

Why Use a Simple Interest Loan Calculator?

If you use a simple interest loan calculator has several benefits you can grab:

- First, it can help you to determine the total cost of a loan, including interest.

- Second, it can help to know the potential return on investment.

- The third is to save time

- Fourth it can reduce any kind of error.

The Importance of Understanding Simple interest loan calculator

Understanding the Simple Interest Loan calculator is crucial for individuals who are seeking loans or mortgages, as it helps them in making informed financial decisions and determine the actual cost of borrowing money.

Knowing the Simple Interest rate and the amount of interest that will be charged on a loan can assist in determining the monthly payments and the total amount that will be repaid to the lender.

It is essential to understand Simple Interest so that one can compare the cost of borrowing from different lenders and make the most informed decision.

In the case of a mortgage, Simple Interest can greatly impact the total cost of the loan and the amount of interest paid over the life of the mortgage.

Hence, it is important for homeowners to understand Simple Interest and its impact on their mortgage payments so that they can make informed decisions and plan their finances accordingly.

How much interest do you pay on a $4000 loan over 3 months at 8% simple interest?

Simple interest is calculated as the product of the principal amount, the interest rate, and the time period. In this case, the principal amount is $4000, the interest rate is 8%, and the time period is 3 months. So, the total interest on a $4000 loan over 3 months at 8% simple interest would be $80.40.

What is 6% interest on a $30000 loan?

I = $30000 * 0.06 * 1 = $1800

Therefore, the interest on a $30000 loan at 6% for 1 year would be $1800.

How much is 5% interest on 100000?

I = $100,000 * 0.05 * 1 = $5,000

Therefore, the interest on $100,000 at 5% for 1 year would be $5,000.

Conclusion

A simple interest calculator is a valuable tool for anyone who needs to calculate the interest on a loan or investment. It is easy to use and can provide quick and accurate results. By understanding the simple interest formula and how to use a simple interest calculator, you can make informed decisions about borrowing and investing your money. Remember to always use a reliable and trustworthy calculator to ensure accurate results.