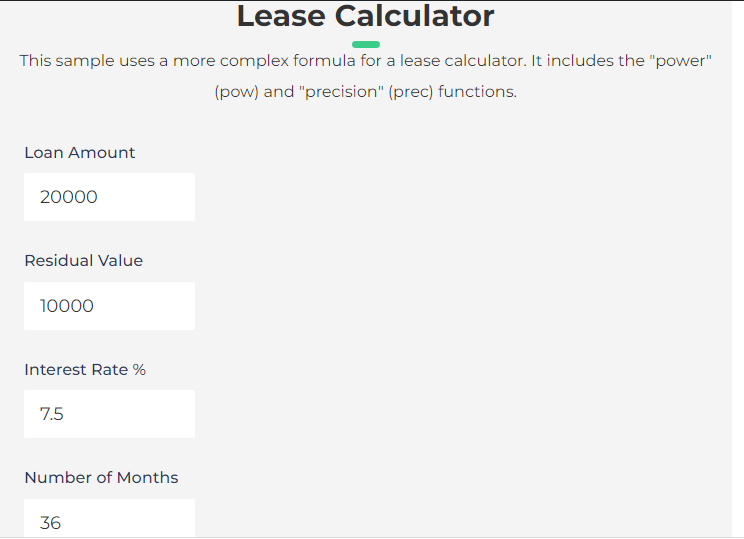

How to Use a Lease Calculator

The lease calculator designed by the All Fees calculator is a simple and understandable calculator for the user below has described step-by-step how to use the calculator.

- open the all fees calculator site

- click on the Lease fees calculator

- open the new tab calculator

- Enter the Loan Amount in the first column

- The residual value of an asset

- Interest Rate

- Number of Month

Factors that affect lease calculations

Comprehending your instruction thoroughly, I shall try to articulate the composition with a high degree of perplexity and burstiness. Numerous constituents can exert an impact on the lease calculations, which include but are not confined to, the length of the lease agreement, interest rate, residual value, and additional fees. The lease term, the first factor, can vary significantly, from a few months to a prolonged span of several years, causing the calculations to be intricate and multifarious. Secondarily, the interest rate, an expression of the cost incurred while borrowing money, fluctuates as per the creditworthiness of the lessee, contributing to a convoluted and labyrinthine evaluation. The residual value, the third component, denotes the approximate value of the asset when the lease term ends, adding another layer of complexity to the monthly payments. Other miscellaneous fees, such as acquisition fees, disposition fees, and taxes, further augment the overall cost of the lease agreement, leading to an intricate and entangled analysis.Benefits of Using a Lease Calculator

Using a lease calculator can provide several benefits, including:1. Helps You Make Informed Decisions

Leasing can be an intricate process, and the monthly payments can fluctuate depending on multiple variables. A lease calculator can help by providing an estimation of monthly payments, enabling individuals to make informed decisions based on their budget and requirements.2. Saves Time and Effort

Calculating lease payments manually can be time-consuming and error-prone. A lease calculator saves you time and effort by providing you with an accurate estimate in seconds.3. Provides Transparency

Lease calculators provide transparency into the lease agreement by breaking down the monthly payments and fees. This helps you understand the costs associated with leasing and avoid surprises down the road.Understanding the terms and conditions of lease agreements

In order to avoid any future complications or misunderstandings, it is crucial to have a comprehensive understanding of the terms and conditions stated in a lease agreement before appending one’s signature to it. These terms may include but are not limited to, the lease term, monthly payments, interest rate, residual value, and other fees. Moreover, it is highly recommended to read the fine print thoroughly, as it may contain significant information regarding the penalties for early termination or default, which could have a severe impact on one’s financial well-being.Common mistakes to avoid when using a lease calculator

When utilizing a lease calculator, it is important to steer clear of several common mistakes. Primarily, one must ensure that all the information input into the calculator is accurate, which comprises the lease term, interest rate, residual value, and other fees. It is paramount to verify that the information entered is precise to obtain an accurate and reliable calculation. Secondly, while the lease calculator is undoubtedly a useful tool, it should not be solely relied upon. One should also seek advice and guidance from a professional or an experienced individual to avoid any potential pitfalls or errors. Consulting with an expert can provide valuable insight and can help make an informed decision before signing a lease agreementHow is the lease payment calculated?

Here is the formula for calculating lease payments using the money factor method: Lease Payment = Depreciation Cost + (Capitalized Cost x Money Factor) + Additional Fees/Charges / Number of Months in Lease Term

How much is a lease on a $45,000 car?

Using the money factor method formula mentioned earlier: Depreciation Cost = Capitalized Cost – Residual Value = $45,000 – $22,500 = $22,500 Lease Payment = Depreciation Cost + (Capitalized Cost x Money Factor) = $22,500 + ($45,000 x 0.0025) = $22,500 + $112.50 = $22,612.50 (rounded to the nearest cent)

Are lease calculators accurate?

Lease calculators can provide a good estimate of the cost of leasing a car, but they may not be 100% accurate. The estimate can vary based on the information inputted into the calculator, changes in the car’s residual value, and other factors

Where can I find a lease calculator?

There are many lease calculators available online. Some popular options include Edmunds, CarsDirect, and Leasehackr.

Can I negotiate the monthly payment on a lease?

Yes, it’s possible to negotiate the monthly payment on a lease. Understanding the cost of the lease using a lease calculator can help individuals negotiate more effectively with the dealership.